Call us: +1-855-202-3299

Email: [email protected]

Auditing Call Reports – Best Practices for Documentation and Review 2023

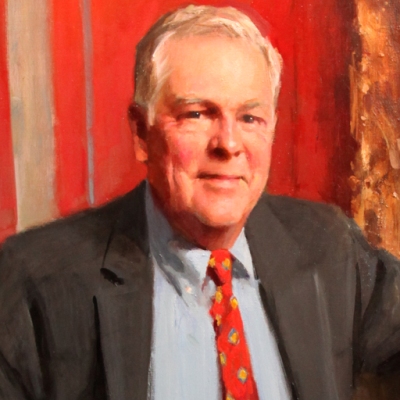

Speaker: Robert Geary

Speaker Designation: Founder, Greenwich Risk Management Advisory Services

Call us: +1-855-202-3299

Email: [email protected]

Speaker: Robert Geary

Speaker Designation: Founder, Greenwich Risk Management Advisory Services

With regulatory agencies increasingly relying on the Call Report as an effective way to monitor and remotely supervise banks, there is greater emphasis on Call Report accuracy. In addition, regulators are more frequently including a Call Report review during on-site examinations. It is imperative that Call Report preparers, reviewers, and auditors understand regulators’ expectations regarding Call Report accuracy, as well as the bank’s procedures for preparation and review.

One key control in mitigating this risk is ensuring that you have adequate documentation in place each quarter so that the next person can pick up the pieces. Maintaining documentation that is well prepared and organized can not only help mitigate risk but also improve your preparation efficiency.

This session will highlight key audit areas, common errors, and best practices for performing and documenting the review of quarterly Call Reports.

National Banks, State Member Banks, and Insured Non-Member Banks are all responsible to submit audit call reports on a quarterly basis. Highly important that audit call reports are prepared accurately and consistent with other financial information reporting.

Do your Call Reports include the information that auditors and examiners are looking for?

If your preparer were to leave unexpectedly tomorrow, could someone else at the bank locate the prior quarter's call report documentation, figure out where the source information came from, and work their way through the next quarter's call report? Many banks, large and small, face this challenge, but the better your documentation, the less painful the recovery when the unexpected occurs.

Join this webinar to get expert advice, tips, and best practices to improve your Call Report process.

After this webinar You’ll be able to -

This webinar will provide valuable insights to -

Robert Geary is the founder of Greenwich Risk Management Advisory Services "LLC" and services as the principal consultant on many of the firm’s consultancy mandates.

Robert has been a banking and finance industry professional for 43 years with 34 years serving in a variety of senior Treasury, financial market, asset management and risk management roles at JP Morgan Chase & Co. For the last 6 years of his career with JP Morgan Chase, Robert had undertaken risk management oversight roles that have included Head of Market, Credit and Operational Risk Management for Chase Asset Management and being Managing Director of Fiduciary Risk Management for the Corporation. During Robert’s career he has served on the Board of Directors of Chase Manhattan Overseas Banking Corporation as well as having served on numerous senior committees. Prior to joining Chase, he held positions at Chemical Bank, Chrysler Financial Corporation and National Bank of North America.

Robert holds a BA degree in Economics from Pace University and did graduate studies in finance at New York University Graduate School of Business. He is a Past President of the New York Athletic Club and is currently a member of the Executive Advisory Board of St. John’s University Department of Accounting and Taxation.