Call us: +1-855-202-3299

Email: [email protected]

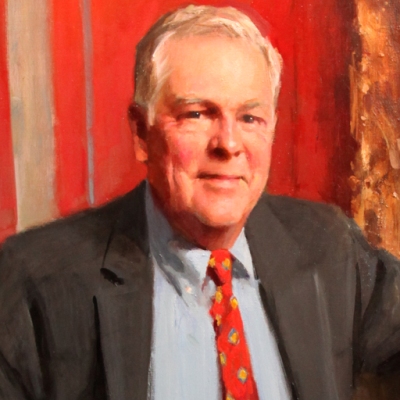

Robert Geary

Founder, Greenwich Risk Management Advisory ServicesRobert Geary is the founder of Greenwich Risk Management Advisory Services "LLC" and services as the principal consultant on many of the firm’s consultancy mandates.

Robert has been a banking and finance industry professional for 43 years with 34 years serving in a variety of senior Treasury, financial market, asset management and risk management roles at JP Morgan Chase & Co. For the last 6 years of his career with JP Morgan Chase, Robert had undertaken risk management oversight roles that have included Head of Market, Credit and Operational Risk Management for Chase Asset Management and being Managing Director of Fiduciary Risk Management for the Corporation. During Robert’s career he has served on the Board of Directors of Chase Manhattan Overseas Banking Corporation as well as having served on numerous senior committees. Prior to joining Chase, he held positions at Chemical Bank, Chrysler Financial Corporation and National Bank of North America.

Robert holds a BA degree in Economics from Pace University and did graduate studies in finance at New York University Graduate School of Business. He is a Past President of the New York Athletic Club and is currently a member of the Executive Advisory Board of St. John’s University Department of Accounting and Taxation.

Recorded-webinar by: Robert Geary

-

-

Auditing Call Reports – Best Practices for Documentation and Review 2023

With regulatory agencies increasingly relying on the Call Report as an effective way to monitor and remotely supervise banks, there is greater emphasis on Call Report accuracy. In addition, regulators are more frequently including a Call Report review during on-site examinations. It is imperative that Call Report preparers, reviewers, and auditors understand regulators’ expectations regarding Call Report accuracy, as well as the bank’s procedures for preparation and review.

One key control in mitigating this risk is ensuring that you have adequate documentation in place each quarter so that the next person can pick up the pieces. Maintaining documentation that is well prepared and organized can not only help mitigate risk but also improve your preparation efficiency.

This session will highlight key audit areas, common errors, and best practices for performing and documenting the review of quarterly Call Reports.

-

US Bank Major Regulator Risk Evaluation Programs: CAMELS, CCAR and CLAR

US bank regulators have continued to enhance their oversight of the major areas of risks present in a bank. The major risk evaluation and rating programs that have been introduced are: CAMELS, CCAR and CLAR. This presentation provides for a thorough review and understanding of these programs.

CAMELS is one of the most significant evaluation methodologies for banks employed by US regulators, namely the Federal Reserve Bank, Comptroller of the Currency and Federal Deposit Insurance Corporation. CAMELS is the titling of the rating system employed by these regulators with the titling standing for each of the components contained in the evaluation methodology. Specifically, a bank’s condition is evaluated and rated with respect to: Capital Adequacy, Asset Quality, Management Quality, Earnings, Liquidity and Sensitivity to Market Risk. The evaluation conducted by this program is intense and quite detailed and, based on a bank’s CAMELS evaluation, a bank is given a rating for each individual CAMELS component as well as an overall composite rating. It is imperative that a bank understand the CAMELS evaluation process, how the evaluation of each component is formulated, how ratings are established and the impact of a rating on a bank’s present and planned business initiatives.

The understanding of CAMELS must exist with executive management, senior business management as well as with all staff responsibility for managing the elements of each CAMELS component.

This presentation addresses:- The evaluation considerations that are applied for each CAMELS component,

- How these considerations translate into the rating of each component,

- The meaning of each component rating

- The formulation of a bank’s CAMELS composite rating

- The meaning of a composite rating

- Actions that may be required by an established rating

Commensurate with the CAMELS evaluation, the FRB conducts two related evaluations:

- CCARS which is stands for “Comprehensive Capital Analysis and Review”, and

- CLAR which stands for “Comprehensive Liquidity Assessment and Review”

Both these evaluations not only test a bank’s current capital adequacy and liquidity adequacy, they also address a bank’s management policies, procedures and practices that ensure a bank’s ongoing management ability to maintain appropriate capital and liquidity standards.

-

Treasury Management – Liquidity, Interest Rate, Foreign Exchange Management!

The Treasury function of all corporations is a key management unit of an organization. It is responsible for managing an entity’s funding, liquidity risk and interest rate risk as well it may engage in foreign currency transactions as a source of swap funding.

Liquidity risk stems from the management of a firm’s asset creation and funding capabilities. Its interest rate risk is a function of the interest maturity structure of its assets relative to the maturity structure of its liabilities. This interest rate risk for a bank is referred to as its interest maturity risk.

A firm may have foreign exchange activity as it engages in the swapping of foreign currencies to generate home currency funding.

The treasury function has a major role in managing the balance sheet of a business and has a management process that involves an ongoing set of daily roles and responsibilities to meet its objectives. The skills required to effectively manage the treasury function are many as well as the tools that are used in the management of its functions. The treasury unit must work closely with those units of the organization which have the responsibility in creating assets and it plays an important role in the pricing of interest-rate sensitive assets. In addition, in the case of a bank, the treasury function may also be commissioned to generate net interest income (NII) for the firm from its management of the firm’s interest rate maturity structure.

Although there are dedicated persons within the treasury function who manage these referenced responsibilities, it is necessary for the senior and executive management of the firm to know and understand the makeup of its balance sheet, the risks that are present and how the risks are being managed. This presentation will focus primarily on a bank’s Treasury function, but the treasury function of nonbank corporations is faced with many of the above-referenced risks and must undertake many of same management processes to manage their risks.

-

SR Letter 11-7 Supervisory Guidance on Model Risk Management

SR Letter 11-7 has become the premier standard for model risk management, with its principles being adopted not only by banks, but also by virtually all U.S. financial institutions.

It addresses model construction, validation and usage. It goes on to review model management responsibilities including oversight, governance and policies.

The guidance also cites the need for uniformity of model management and policies across businesses within an organization. This training program will detail why SR Letter 11-7 has become the gold standard for model risk management, with its principle being adopted not only by banks but also virtually all U.S. financial institutions.

-