Are you looking to enhance your grasp of payroll tax management and stay ahead in the ever-evolving world of financial regulations? Payroll tax management can come with its fair share of challenges, from employee inquiries to unexpected discrepancies.

Staying compliant with payroll tax regulations is not just a legal requirement but a vital aspect of maintaining your business's reputation and financial stability.

Learn from real-world examples and gain practical solutions to address these issues proactively, saving you time, resources, and potential disruptions. Join us for the enlightening webinar on "Mastering Payroll Tax Management," where we'll cover essential topics that can significantly impact your business's financial health and compliance standing.

The Learning Objective of the session is to:

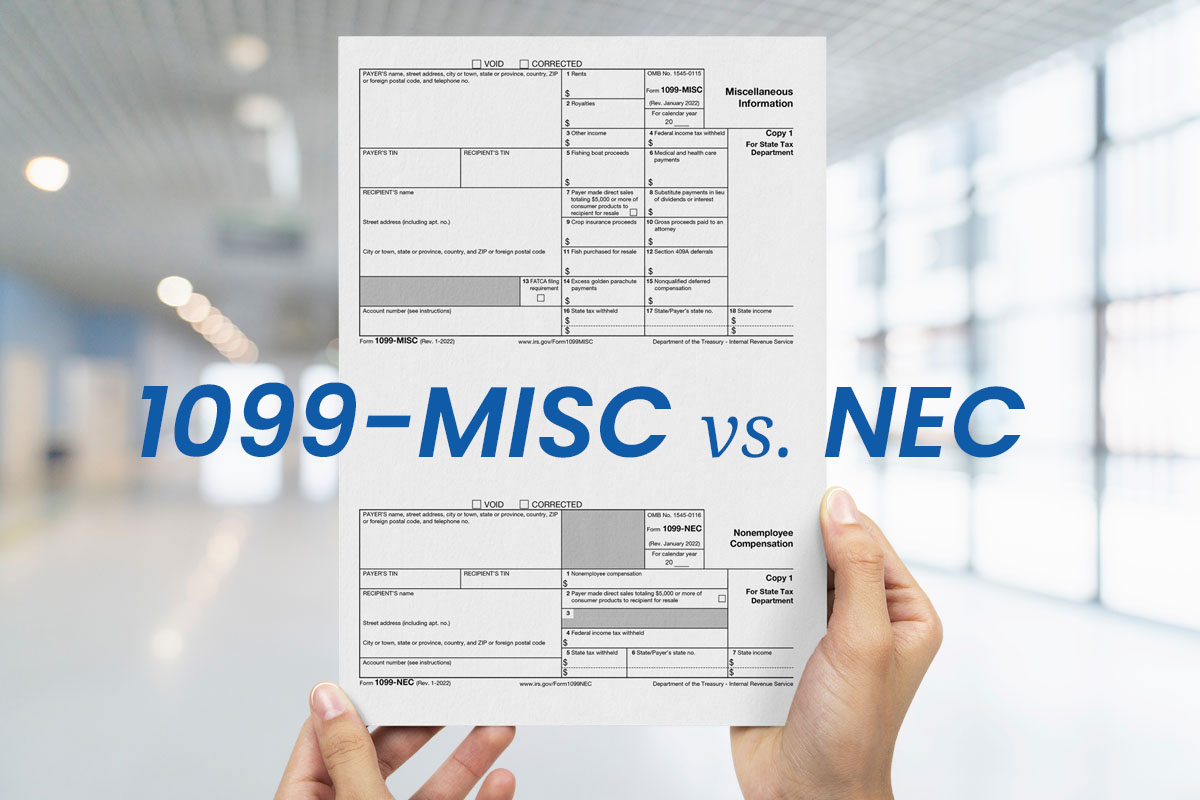

- Provide participants with a comprehensive understanding of amending W-2's and 941's, enabling them to rectify errors and maintain accurate tax reporting.

- Equip attendees with insights into proper tax withholding calculations, helping them ensure accurate employee tax contributions and compliance.

- Offer practical strategies for effectively managing multi-state payroll tax complexities, including navigating diverse tax regulations and reporting requirements.

- Present real-world solutions to common payroll tax challenges, empowering participants to proactively address employee inquiries, discrepancies, and related issues.

- Enhance participants' expertise in payroll tax compliance, enabling them to optimize withholding strategies, prevent penalties, and minimize financial risks for their organizations.