Call us: +1-855-202-3299

Email: [email protected]

1099 MISC and NEC Filing: Need to Know Updates for 2024

Speaker: Jason Dinesen

Speaker Designation: Tax Expert

Call us: +1-855-202-3299

Email: [email protected]

Speaker: Jason Dinesen

Speaker Designation: Tax Expert

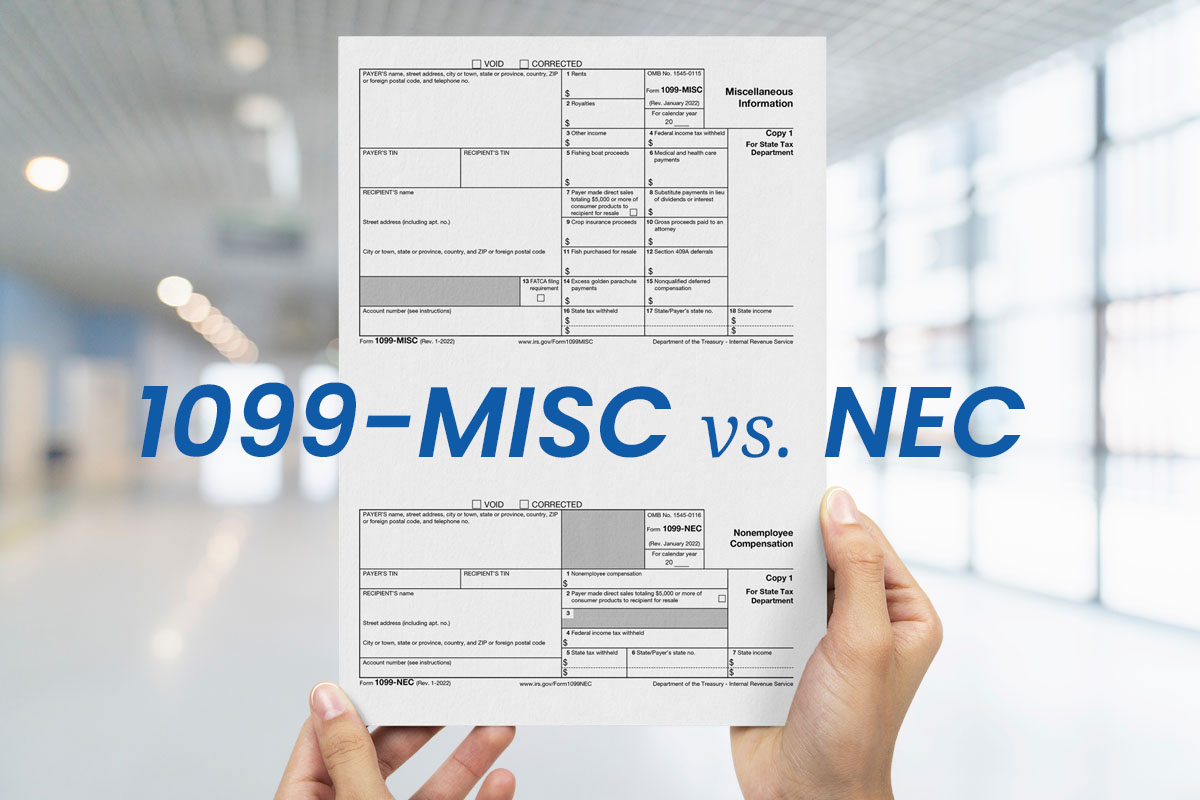

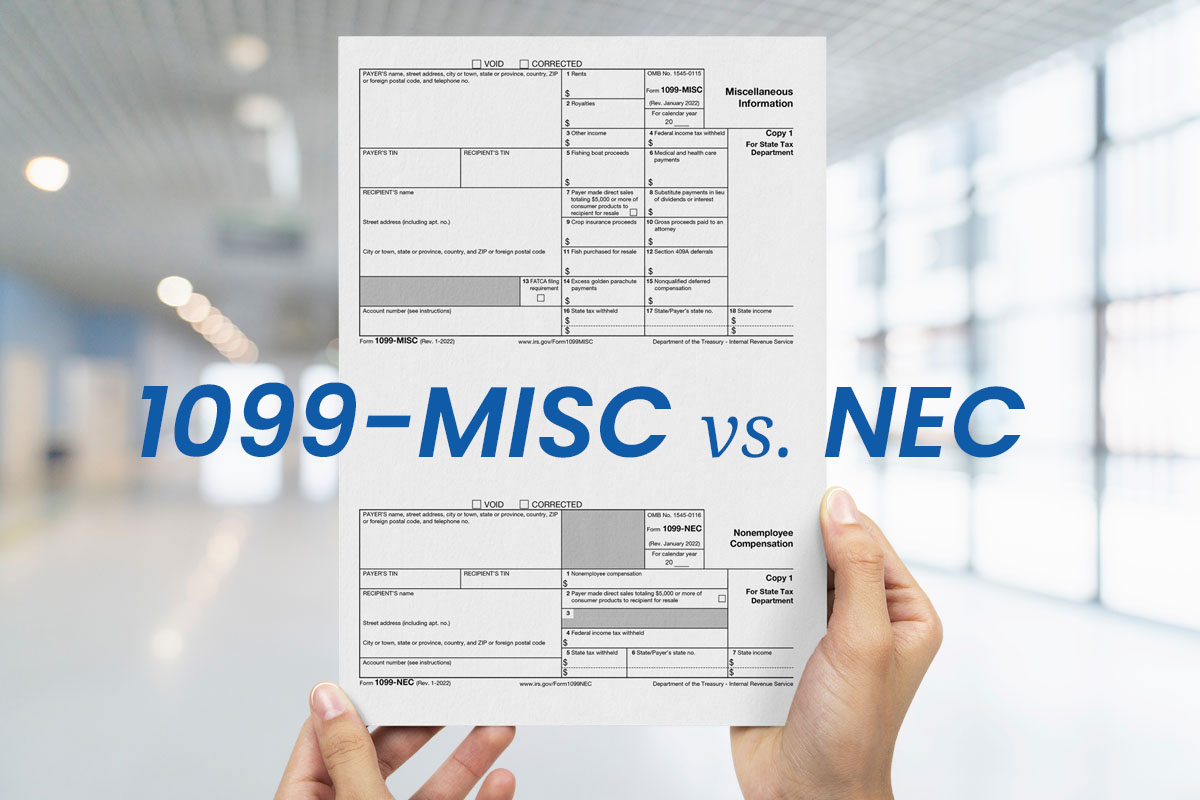

With the recent updates to Forms 1099-MISC and 1099-NEC, the 1099 filing season has added a whole new layer of complexities. Whether you are new to the 1099 filing process or seeking an update, this course will help minimize 1099 filing mistakes while breaking down the toughest 1099 payee and reporting situations as part of an in-depth box-by-box review of the revised Forms 1099-MISC and 1099-NEC.

In this webinar, 1099 expert Jason Dinesen (EA, LPA) will walk through common issues related to documenting, validating, and reporting payee information on IRS Forms 1099-MISC and 1099-NEC. He will also explain best practices for addressing many of the common issues that come up on the new 1099 forms.

Both the 1099-MISC and 1099-NEC forms are essential tools for ensuring proper tax reporting and compliance for miscellaneous and nonemployee income. Understanding when and how to use these forms is crucial for businesses and individuals involved in such transactions.

Staying informed about the changes to 1099-MISC and 1099-NEC filing requirements is crucial for businesses to maintain compliance and avoid penalties. As the IRS continues to refine reporting processes, understanding these updates will help businesses manage their tax obligations efficiently.

The 1099 forms, particularly the 1099-MISC and 1099-NEC, are crucial documents in the U.S. tax system for reporting various types of income. The 1099 series forms are used in the United States for reporting various types of income other than wages, salaries, and tips, which are reported on a W-2 form. Among these, the 1099-MISC and 1099-NEC forms are widely used by businesses and individuals for reporting payments made to non-employees, independent contractors, freelancers, and other entities.

Jason Dinesen (EA, LPA) is a tax nerd, entrepreneur, tax expert and a well-known presenter of continuing education courses. Known for his sharp tax interpretations, he is one of the quickest to bring the analysis of the latest tax updates and IRS guidance to the professional community.

Jason has coached over 200,000 accounting, tax, and HR professionals on various topics of accounting, individual taxation, corporate taxation, professional ethics and much more. He has presented over dozens of webinars on Form 1099 (for 10 years on this subject!); marriage in the tax code; tax updates; the new Form W-4, payroll updates, filing status, tax credit and other issues relating to the modern-day household setting.

He also teaches 2 classes at Simpson College, Individual Income Tax and Business Analytics.

Jason always had a knack for radio shows and has and regularly features as an anchor for Radio Iowa.

Jason was born and raised in Iowa and has a degree in corporate communications from Simpson College in Indianola. He has a big family that includes his wife, two sons, 4 cats and 2 dogs. His other hobbies include being a season ticket holder to University of Iowa football.