Payroll is one thing that all businesses have in common. Along with processing payroll come many different payroll records required to process the payroll. Each type of record has different requirements for how long you must retain those records.

Payroll departments receive and submit hundreds of thousands of bits of data every year. Employee master file data such as name and social security number, employee forms such the Form W-4, report to the IRS such as Form 941, state unemployment insurance quarterly returns, termination dates for employees, and even child support withholding orders.

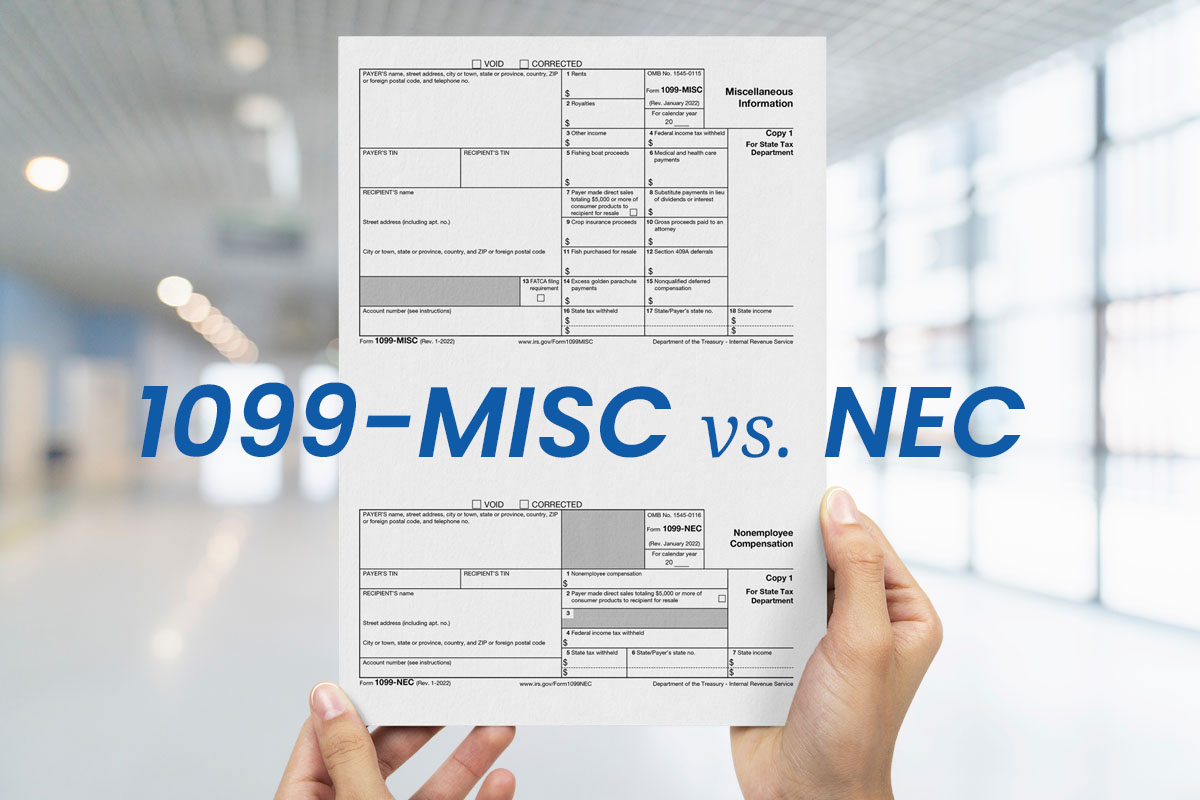

In this online webinar speaker, Dayna Reum will review record retention requirements by the agency.

Special record retention concerns will be reviewed such as how to handle records during a merger or acquisition. Legislative updates will be reviewed along with common errors employers make that can cause your company money regarding record retention policies.