Call us: +1-855-202-3299

Email: [email protected]

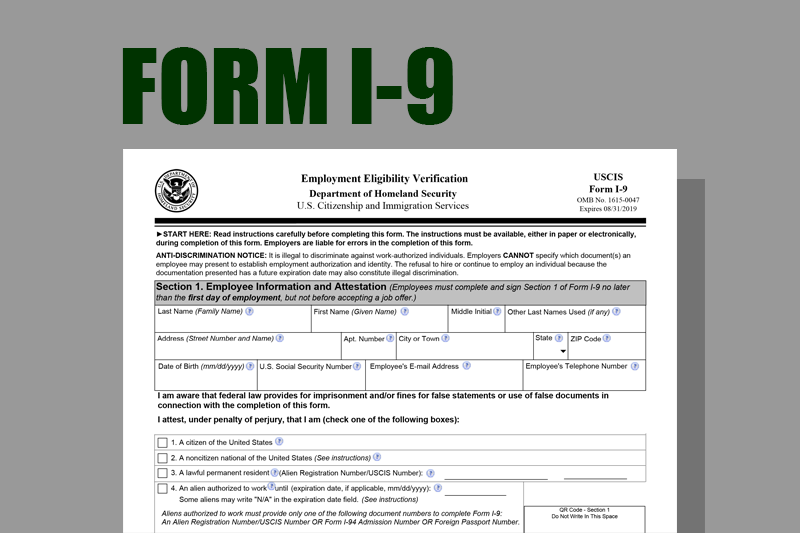

Navigating Form I-9 Compliance: A Comprehensive Guide to Recent Changes and Best Practices

In a dynamic regulatory landscape, staying abreast of changes is crucial for employers, especially when it comes to the U.S. Citizenship and Immigration Services (USCIS) Form I-9. As of August 1, 2023, significant modifications have been introduced to streamline the completion process and enhance compliance. This comprehensive guide explores the latest updates, the purpose of Form I-9, and the essential compliance requirements employers must adhere to.

Overview of Recent Changes:

The USCIS issued a new Form I-9 on August 1, 2023, with the objective of simplifying the completion process. Employers can continue using the current form until October 31, 2023, after which noncompliance penalties may be imposed for failure to transition to the new form.

Transition from COVID-19 Flexibilities:

Temporary flexibilities related to virtual remote inspection of documents, implemented during the COVID-19 pandemic, have sunset. Employers are now required to return to the pre-pandemic practice of physically inspecting documentation provided by new employees. Employers who conducted virtual remote inspections have until August 30, 2023, to perform in-person, physical document inspections and annotate the Form I-9 accordingly.

Essential Compliance Requirements:

When hiring new employees, employers must adhere to crucial compliance requirements, ensuring the completion and retention of paperwork for each new hire, including the Form I-9.

Understanding Form I-9:

The Form I-9, Employment Eligibility Verification, is mandated by the USCIS to establish an employee's eligibility to work in the U.S. It serves the dual purpose of verifying identity and employment authorization. The USCIS periodically updates the form, underscoring the importance of using the most current version available on the USCIS website.

Who Must Complete Form I-9:

Since November 1986, all U.S. employers, irrespective of citizenship status, are responsible for ensuring that newly hired employees complete Form I-9. Both the employee and employer participate in the completion process. Employers must accept a range of acceptable documents presented by employees and avoid discriminatory hiring practices.

Accessing Form I-9:

Employers can download Form I-9, along with instructions, from the USCIS website. The site also provides related documents, instructions in Spanish, and a link to the comprehensive M-274 handbook, aiding employers in understanding their employment eligibility verification obligations.

Form I-9 Completion Process:

The Form I-9 consists of two sections, with Section I completed by the employee and Sections II and Supplement B (formerly Section III) completed by the employer or an authorized representative. Employers must provide clear instructions on how to complete the form, and additional guidance can be found in the employer handbook (M-274).

Documents Required for Form I-9:

Employees may need to present one or more documents to establish identity and employment eligibility, with choices outlined in the Lists of Acceptable Documents on the Form I-9 Instructions. Employers must examine these documents to ensure they reasonably appear genuine and relate to the employee.

Form I-9 Storage and Retention:

Employers are mandated to retain completed Form I-9s for each newly hired employee while they work for the company and for a specified period after employment ends. Employers can retain completed forms in paper or electronic format, with additional guidelines available on the USCIS website.

Consequences of Noncompliance:

Failure to obtain and retain completed Forms I-9 can result in severe consequences. U.S. Immigration and Customs Enforcement can request Form I-9s as part of a Notice of Inspection (NOI), and penalties for noncompliance can range from $230 to $1,948 per form for first offenses. Employers should be prepared to provide supporting documentation during audits.

Self-Audits for Form I-9 Compliance:

Conducting self-audits of completed Form I-9s is a proactive measure to avoid potential errors. The USCIS provides guidance on correcting forms, and common errors include missing information, unsigned forms, and inaccuracies. Employers can initiate corrections following the USCIS guidelines.

Recent Updates and Penalties:

The issuance of the new Form I-9 on August 1, 2023, brings changes to the documentation review process and penalties for noncompliance. Penalties can range from $252 to $2,507 for significant or inaccurate information, with steeper penalties for subsequent offenses. The Department of Homeland Security's I-9 Inspection Process flowchart has also been updated.

I-9 vs. W-9: Clearing the Confusion:

Distinguishing between Form I-9 and Form W-9 is crucial. While Form I-9 verifies employment eligibility, Form W-9 is an IRS tax form completed by third parties such as independent contractors. Employers must ensure the correct completion of each form to avoid financial penalties.

Conclusion:

Form I-9 compliance is a critical aspect of successful onboarding, and employers must stay informed about recent changes and best practices. By understanding the purpose of Form I-9, adhering to compliance requirements, and conducting self-audits, employers can navigate the complexities of employment eligibility verification seamlessly. For ongoing support and guidance, employers may consider consulting with an HR professional to ensure robust onboarding procedures and regulatory compliance.